Maximize giving potential while supporting your Alma Mater

//Blogs

Author: Ranga Srinivasan (IITM 90 EE batch)

As an alumni, giving back to your alma mater can be a rewarding experience, both emotionally and financially. When ready for charitable giving, you are often faced with choices such as, donating from a savings account, stock account, or a retirement account, which can appear simple at the outset but is nuanced in terms of maximizing giving. It is not very uncommon for a typical donor to face some questions.

- I have appreciated Stock. How can I optimize my donation ?

- I want to donate regularly each year

- I want to donate from my IRA, since I am retired

- I want to make a big long-term commitment

- I would like to leave money to charity after my time

The US Government encourages charitable giving in the form of tax-breaks, so by planning giving strategically, your charity can get more.

What are my Options ?

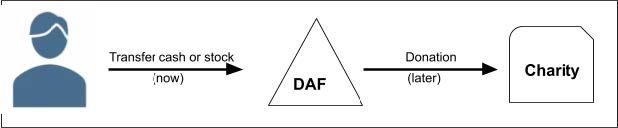

If you are undecided about the specific charities, but ready to earmark funds now for a future donation, vehicles like Donor Advised Funds (DAF) are great choices, since they allow compounding of assets inside the account and increase the giving level, while enjoying some tax-advantages at the same time. If you have enjoyed tremendous career success, and accumulated a significant estate, setting up Charitable Trusts may be important

Charitable Trusts, while complex to set up and administer, can be a powerful vehicle that allows setting up income streams for beneficiaries, potentially defer capital gains tax, or lower your estate tax

Now, let's get into more specific situations.

How can Qualified Charitable Distributions (QCDs) help with my IRAs ?

If you are over 72 and taking Required Minimum Distributions ( RMD) from your Individual Retirement Account (IRA), and don't need the cash flow from distributions to meet living expenses, you have the option to donate some of these distributions to charity, since the IRS has waived ordinary income taxes owed on the distributions as long as they are used for charitable purposes. This approach allows you to fulfill your RMD obligations while supporting a cause you care about, potentially lowering tax burden from the RMDs. If you are over 70 1⁄2 ,QCDs allow tax-free transfers directly from IRAs to qualified charities.

Some benefits include:

- Up to $105,000 per year can be donated tax-free.

- QCDs count towards satisfying RMDs if over 73

- The donated amount is excluded from taxable income, potentially lowering the adonor's tax bracket

- May reduce the cost of Medicare premiums by lowering Adjusted Gross Income (AGI)

How can I give appreciated stock using a Donor Advised Fund ?

Are you ready to create and fund an investment account earmarked for future charitable donations ? A DAF can be a perfect choice since it facilitates charitable giving by allowing contribution of investment assets to a fund, receiving an immediate tax deduction, and then recommending grants to charities over time. Contributions made to charities through a DAF account instead of writing checks from your investment account, has some advantages:

Funding the DAF Account : Appreciated securities (in the form of stocks or mutual funds), can be moved to a DAF account, and thus avoid capital gains taxes on the appreciation, while taking an immediate tax deduction as long as it does not exceed a % of Adjusted Gross Income (AGI), for the calendar year.

Investment Growth: Inside the DAF Account, assets can be invested for tax-free growth, potentially increasing the amount available for charitable giving Flexibility and Control: Donors can recommend grants to any eligible IRS approved 501(C)(3) public charity at their own pace. DAFs also simplify the process of charitable giving by consolidating multiple donations into a single account, providing one tax receipt, and allowing for strategic, long-term philanthropic planning.

Accessibility: DAFs are accessible to a wide range of donors, not just the ultra-wealthy, and can accept a variety of asset types, including complex assets like private stock and real estate

Can I do some Estate Planning with IRAs and DAFs ?

Designating your favorite charity as a beneficiary of your IRA can also be a strategic estate planning move, as it can potentially reduce income and estate taxes for heirs and ensure your legacy supports future needs of charity. You can avoid including unused IRAs in estate tax calculations and potentially avoid double taxation on inherited IRAs.

You can also name your DAF as a beneficiary of your IRA for posthumous giving. This ensures that your charity benefits from your generosity even after your lifetime.

How do Charitable Trusts help me make a big long term commitment ?

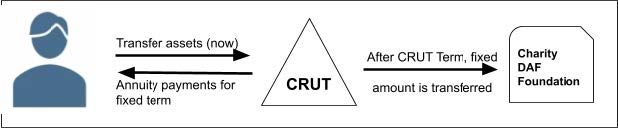

Setting up Charitable Trusts can be important depending on your charitable goals, and financial situation. Two Trusts that are popular are Charitable Remainder Unit Trust (CRUT) and Charitable Lead Annuity Trust (CLAT) . CRUTs and CLATs are typically used by ultra-high-networth donors, who have charitable intentions and at the same time interested in tax deferral of capital gains, income streams to beneficiaries , potentially some ordinary income

tax deduction, or removal of assets out of their estate . We will get into more specifics of these 2 trusts.

CRUTs

A CRUT is an irrevocable trust setup for a fixed term (10, 20 or 30 years), during which non-charitable beneficiaries receive income streams. After this period, the remaining assets in the trust are transferred to a designated charity.

Key features include:

Income Stream: Beneficiaries receive a steady income for life or a set term, which can be beneficial for retirement planning or providing for family members.

Tax Benefits: Donors can potentially avoid capital gains taxes on appreciated assets placed in the trust and receive an immediate charitable income tax deduction based on the Present Value (PV) of the remainder interest that will eventually go to charity

Types: There are two main types of CRTs:

Charitable Remainder Annuity Trusts (CRATs), which pay a fixed annuity, and Charitable Remainder Unitrusts (CRUTs), which pay a fixed percentage of the trust's value, recalculated annually CLATs. A CLAT reverses the sequence of recipients as compared to CRUT - Charities get income

streams for a fixed period of years (anywhere from 10 to 30), and at the end, the remainder of assets get passed on beneficiaries.

Key features include:

Immediate Charitable Impact: The charity receives regular payments during the trust term, making it ideal for those who want to support a charity in the short term.

Tax Benefits: CLATs can offer potentially significant gift and estate tax benefits. The donor can take a charitable gift tax deduction for the present value of the annuity payments to the charity. The remainder assets that gets transferred to beneficiaries is potentially excluded from estate tax calculations of the donor ( Grantor)

Flexibility: The remaining assets after the term can revert to the donor or be passed on to heirs, potentially reducing estate taxes

How do I choose Between CRUT and CLAT?

The decision between a CRUT and a CLAT depends on your financial goals and charitable intentions:

Income Needs: If you need a steady income stream now or in retirement, a CRUT might be more beneficial.

Immediate Charitable Support: If you prefer to support a charity immediately and potentially reduce estate taxes, a CLAT could be the better choice.

Tax Considerations: Both trusts offer potential tax benefits but of different kinds, as the specifics can vary. It is highly recommended to consult a Tax Advisor before making the choice. CRUTs in general can offer potential income tax benefits and capital gains tax deferral, while CLATs can be advantageous for gift and estate tax planning.

Summary

By exploring these charitable giving options, donors can make a meaningful impact on their charity's future while optimizing their tax savings. Please consult your financial advisor, tax professional and estate attorney, to get guidance on maximizing your giving.

Disclosures :

- Ranga co-runs Everest (https://everest-mgmt.com) , a boutique wealth management firm based out of the Silicon Valley. Many of the strategies described in this article are currently used by his firm.

- IIT Madras Foundation is a 501(C)(3) non-profit organization providing a platform for Alumni to donate various development programs @ IITM , and the IIT Madras Endowment fund.

- Illustrations and references for tax-reduction are not to be construed as Tax Advice. Please consult with a Tax Professional with regards to your specific situation.

- IRS allows tax deduction for up to 30% of AGI for donation for non-cash contributions, and 60% of AGI for cash contributions. Please consult with your CPA for specifics.

- Some of the typical use cases are described here. For specific recommendations, please consult with your estate attorney, financial advisor, and tax planner.

- Setting up Charitable Trusts should not be initiated without expert consultation from a team of Estate Attorney, Tax Advisor, and Financial Advisor.